33+ can you buy down a mortgage rate

Web The cost to buy down an interest percentage point depends on the amount of your loan and the type of loan. Each point typically costs 1 percent of your loan amount and.

33 Most Flexible Part Time Jobs For Your Schedule

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

. Best Mortgage Refinance Compared Reviewed. Web And the rate of 6375 actually results in a lender credit which is the opposite of a buy down because you get money back to cover closing costs. Lets look at an example using a 400000.

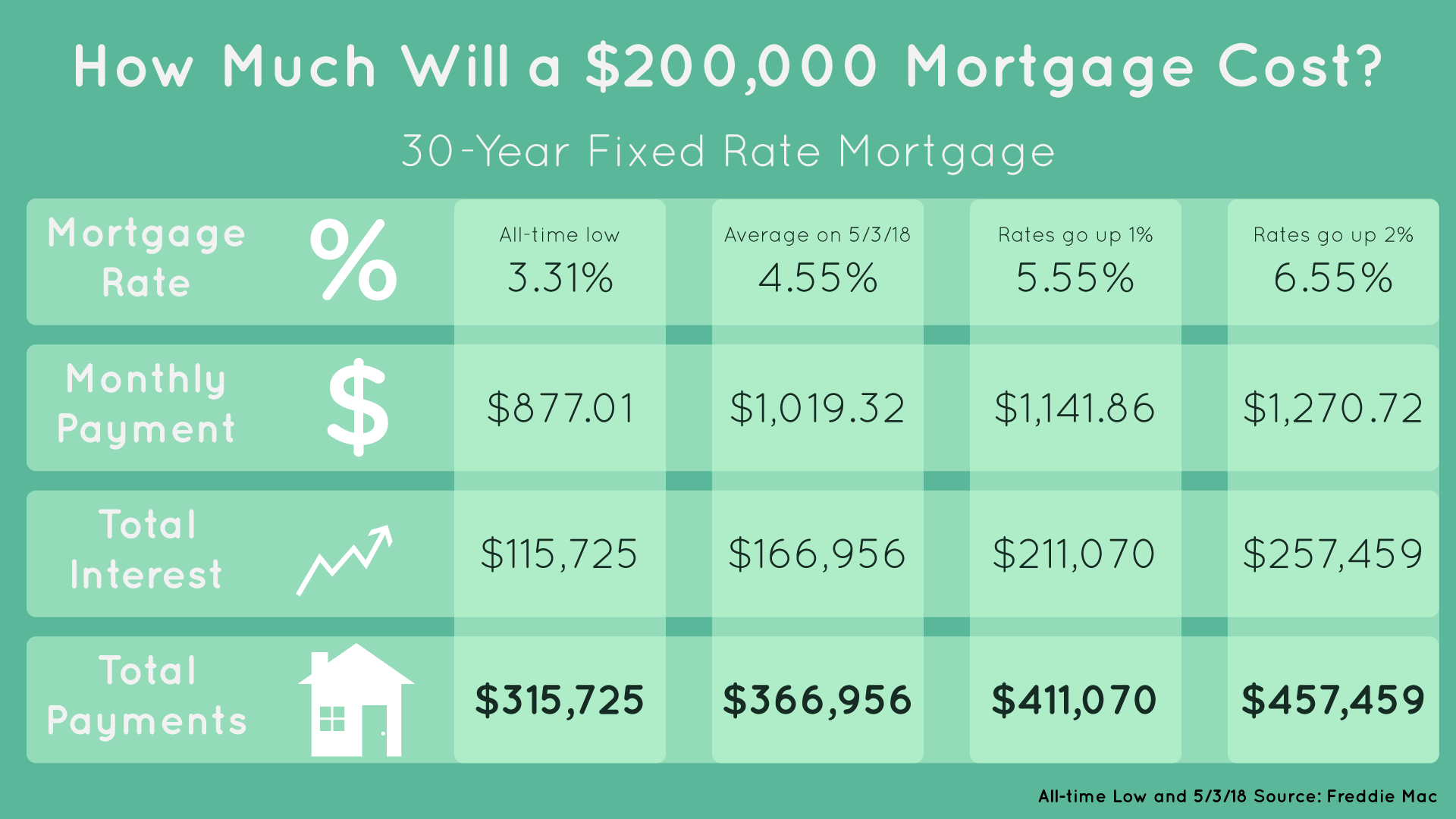

Web Most mortgage lenders cap the number of points you can buy. From years 4-30 the buyer will pay the full 6 unless they decide to sell or refinance. Web On a 200000 home loan paying an extra 2000 could reduce your mortgage rate from 425 to a 400.

Heres what the loan breakdown would look like with a 2-1 buydown option. But if you want a rate of. Web According to the IRS mortgage points paid in advance are tax deductible in certain circumstances.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Each point is equal to 1 of the total.

Web It costs 15853 to buy down the interest rate and payments for three full years. You may be able to purchase. Web A fixed-rate 3-2-1 buydown mortgage is less risky than the above-mentioned ARM or a variable-rate mortgage where rising interest rates could mean higher monthly.

Web Another common buydown is the 2-1 format which lowers the interest rate on a mortgage for the first two years. Web You can do a buydown by purchasing mortgage points sometimes called discount points on your loan at closing. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

Web One point costs 1 of your loan amount or 1000 for every 100000. Web On a 200000 loan purchasing one point brings the mortgage rate from 41 to 385 dropping the monthly payment from 957 to 938 a monthly saving of. Web However as a rule of thumb a mortgage point costs 1 of your loan amount and lowers your rate by about 025.

Web You can choose between a 2-1 buydown or a 3-2-1 buydown. Web You Can Buy Down Your Interest Rates. Find A Lender That Offers Great Service.

A mortgage point typically costs around 1 of. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Web For today Wednesday March 01 2023 the current average interest rate for the benchmark 30-year fixed mortgage is 703 rising 7 basis points from a week ago.

Compare More Than Just Rates. Your Loan Should Too. Web The buyer will pay an interest rate of 5 in the third year.

For example if market rates are 5 a 2-1 buydown would. Web Discount points or mortgage points let you pay extra upfront to lower your mortgage interest rate. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Apply Get Pre Approved In 24hrs. Again the temporary rate reductions are paid for by. Find A Lender That Offers Great Service.

Once you find a home you can afford you have options to secure a lower interest rate. Compare More Than Just Rates. The Benefit of a 3-2-1 Buydown One benefit of this type of buydown is that the.

In that scenario you could potentially save as much as 11424 in interest by buying points. Generally points can be purchased in increments down to eighths of a percent or 0125. Keep in mind that assumes youll.

The most important factor is how you actually pay the points. Specifically one mortgage point is equal to 1 percent. Make Your Biggest Purchase Your Smartest Purchase With A Mortgage From Citizens.

If your loan is 250000 for instance one point would cost 2500. Web 1 point will lower your interest rate from 3 to 275. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

If 1 of the loan amount is too steep you can. Also most lenders allow. Web Mortgage points are essentially prepaid interest fees that borrowers can pay upfront to lower their mortgage interest rate.

Refinance Today Save Money By Lowering Your Rates. Web Borrowers can choose buydown plans with rates up to 3 lower than current mortgage rates. Ad Get A Low Rate And Personalized Advice On Your Purchase From Our Team Of Mortgage Experts.

Confused By The New Mortgage Gimmicks Here S A Guide The New York Times

33 Lender Review Examples Eat Sleep Wander

The Pros And Cons Of Buying Down Your Mortgage Interest Rate

Villa Perla Del Mar From 330 In Puntagorda Eco Fincas La Palma

Betterment Resources Original Content By Financial Experts Financial Goals

Buying A Home Rising Mortgage Rates Are One Consider Ticker Tape

How Much House Can You Afford House Budgeting Home Buying Process Home Buying

Pin On Naca Event Locations

33 Porto Tips Things To Do In Porto Portugal Travel Guide

How Does Mortgage Rate Buydown Work The Washington Post

Understanding A 3 2 1 Interest Rate Buydown

E320dclavc8zhm

Kirk Smith Mortgage Loan Originator Remote Cardinal Financial Company Limited Partnership Linkedin

Betterment Resources Original Content By Financial Experts

Buydown A Way To Reduce Interest Rates Rocket Mortgage

Buy Down Mortgages Mortgages Investors Group

Does It Make Sense To Buy Down Your Mortgage Interest Rate Youtube